A Complete Breakdown of Fees, FBA & Hidden Costs

Most Amazon sellers reach a point where something does not quite add up. Sales are coming in, the product seems to be performing well, and revenue looks promising. But when the month ends, and expenses are tallied, the profit is far lower than expected. That disconnect is what pushes many sellers to ask a crucial question, how much does it really cost to sell on Amazon in 2026?

The challenge is not that Amazon hides its fees. It is that the costs are spread across multiple layers and do not always show up at the same time. Seller plan fees, referral fees, fulfillment charges, storage costs, advertising spend, and returns all play a role. Individually, each expense may seem manageable. Combined, they can significantly impact margins if they are not fully understood from the start.

In 2026, this matters more than ever. Competition has increased across nearly every category, Amazon advertising has become a necessity rather than a growth lever, and fulfillment pricing updates mean older cost assumptions no longer hold up. Sellers who rely on rough estimates or outdated calculators often realize too late that their pricing strategy does not leave enough room for profit.

This article provides a complete breakdown of what it really costs to sell on Amazon in 2026, covering mandatory fees, Fulfillment by Amazon (FBA) expenses, and the additional costs sellers often overlook. The goal is to give you a clear, realistic picture of where your money actually goes, so you can plan accurately, price with confidence, and protect your margins as your Amazon business grows.

What Are Amazon’s Seller Plans, and How Much Do They Cost in 2026?

Every Amazon seller begins by choosing a selling plan, and while this step may feel straightforward, it quietly sets the foundation for your entire cost structure. The plan you select determines not only what you pay upfront, but also how easily you can scale, advertise, and compete once your products go live.

In the U.S., Amazon offers two primary selling plans: the Individual plan and the Professional plan. Each is designed for a different type of seller, and the right choice largely depends on how many products you expect to sell and how seriously you plan to grow your business on the platform.

The Individual seller plan does not charge a monthly subscription fee. Instead, Amazon applies a $0.99 fee to every item sold. This option is commonly chosen by casual sellers or those testing a product idea with very low sales volume. While it can work in the early stages, the per-item fee quickly becomes costly as orders increase. In addition, sellers on this plan have limited access to advanced tools and are restricted from using many advertising features, which can make it difficult to compete in crowded categories.

The Professional seller plan costs $39.99 per month, regardless of how many items you sell. For most serious sellers, this plan is the more practical and scalable option. It unlocks access to Amazon advertising, bulk listing tools, advanced sales reports, and additional selling features that are essential for growth. When evaluating how much does it really cost to sell on Amazon in 2026, most sellers should treat the Professional plan as a baseline operating expense rather than an optional upgrade.

While seller plans determine how you access Amazon’s marketplace, they only represent the starting point of the cost equation. The real financial impact begins once a product actually sells. From that moment on, Amazon applies a series of fees tied directly to each transaction, and these charges ultimately determine how much revenue a seller keeps after every order.

Understanding these per-sale costs is critical, because they affect pricing, profit margins, and long-term sustainability. Let us have a look at them.

What Are Amazon Referral Fees, and Why Do They Apply to Every Sale?

Amazon’s Commission for Marketplace Access

Once a seller plan is active and a product goes live, Amazon’s referral fee becomes the first unavoidable cost tied to each successful sale. This fee applies automatically whenever an order is completed, regardless of whether the seller uses Fulfillment by Amazon, ships orders independently, or runs paid advertising. Referral fees exist because Amazon operates as a marketplace, and sellers pay a commission for access to its massive customer base and built-in buyer trust.

How Referral Fees Are Calculated

Referral fees are calculated as a percentage of the product’s selling price. The percentage varies by category, which means the cost impact can differ significantly depending on what you sell. In 2026, most categories fall within an 8 percent to 15 percent range, although some categories include minimum referral fees that apply even when an item is priced very low. This structure makes it essential for sellers to understand category-specific rates before finalizing product pricing.

Why Referral Fees Impact Every Sale Equally

Unlike advertising or fulfillment costs, referral fees apply uniformly to every sale. Whether a product sells organically or through paid ads, Amazon deducts its commission before any other costs are considered. Because of this, referral fees consistently reduce gross revenue and play a foundational role in determining whether a product can be profitable at scale.

The Relationship Between Pricing and Referral Fees

One detail many sellers overlook is how referral fees scale with price. As a product’s selling price increases, the dollar amount Amazon takes from each sale increases as well. While higher pricing may improve perceived value or revenue on paper, it can also amplify referral fee deductions if margins are not carefully planned. This makes referral fees a critical factor when testing pricing strategies or launching premium-priced products.

What Is Included in the Referral Fee Calculation

Referral fees are typically calculated on the total sales price, which may include shipping charges or gift-wrapping fees depending on how a listing is structured. This means sellers need to factor referral fees into their total landed cost calculations rather than treating them as a separate or secondary expense. Failing to do so often leads to inaccurate profit forecasts and unexpected margin erosion.

Why Referral Fees Set the Stage for All Other Costs

Referral fees represent the first major deduction from every Amazon sale. Before fulfillment costs, storage fees, advertising spend, or returns are accounted for, Amazon has already taken its share. For sellers trying to understand how much does it really cost to sell on Amazon in 2026, referral fees are the starting point for every profitability calculation and the baseline against which all other expenses must be measured.

Once referral fees are fully understood, sellers are better equipped to evaluate the next layer of costs, how products are stored, picked, packed, and delivered to customers, particularly when using Fulfillment by Amazon.

How FBA Fees Factor Into Your Overall Amazon Costs?

Fulfillment by Amazon, commonly known as FBA, allows sellers to outsource storage, order processing, shipping, customer service, and returns to Amazon. Instead of handling logistics independently, sellers send inventory to Amazon’s fulfillment centers, and Amazon takes care of the rest once an order is placed. This convenience is one of the main reasons FBA is so widely used, but it also introduces a layered fee structure that sellers must understand clearly.

How FBA Fulfillment Fees Are Charged

FBA fulfillment fees are charged on a per-unit basis and are primarily determined by a product’s size and weight. Each time an item sells, Amazon charges a fee to cover picking the item from storage, packing it, shipping it to the customer, and handling customer service. In 2026, these fees vary widely depending on whether a product falls into standard-size or oversized categories, making packaging decisions and dimensional accuracy critical to cost control.

The Role of Product Size and Weight in FBA Costs

Even small changes in product dimensions or weight can significantly impact FBA fees. Products that exceed standard size thresholds are classified as oversized, which can result in substantially higher fulfillment costs per unit. Sellers often underestimate how packaging choices affect FBA fees, only to discover later that their fulfillment costs are eating into margins more than expected.

Monthly Inventory Storage Fees

In addition to per-unit fulfillment charges, Amazon applies monthly storage fees for inventory stored in its fulfillment centers. These fees are calculated based on the volume of space your inventory occupies and are charged per cubic foot. Storage costs tend to increase during peak seasons, particularly in the final quarter of the year, which means inventory planning becomes especially important for sellers relying heavily on FBA.

Long-Term Storage and Inventory Aging Costs

Inventory that sits in Amazon’s warehouses for extended periods can trigger additional fees. In 2026, Amazon continues to discourage overstocking by applying inventory aging surcharges to products that remain unsold beyond specific time thresholds. These fees are designed to push sellers toward better demand forecasting and inventory turnover, but they can catch newer sellers off guard if sales velocity is slower than anticipated.

Why FBA Fees Are Often Underestimated

Many sellers focus only on the advertised fulfillment fee and overlook storage, inventory aging, and seasonal rate increases. When these costs are combined, FBA can become one of the largest expense categories in an Amazon business. Without careful monitoring, sellers may believe a product is profitable based on sales performance alone, only to realize later that fulfillment costs have significantly reduced net margins.

When FBA Makes Financial Sense

Despite the costs, FBA can still be a strategic advantage. Products fulfilled through FBA are eligible for Prime shipping, which can improve conversion rates and customer trust. For sellers with fast-moving inventory, predictable demand, and well-optimized packaging, the convenience and scalability of FBA often justify the added expense.

Understanding FBA fees is essential to calculating the true cost of selling on Amazon in 2026. Once fulfillment costs are clear, the next major factor to evaluate is inventory management and storage-related expenses, which play a growing role in long-term profitability.

How FBM Changes Fulfillment and Shipping Costs?

What Fulfilled by Merchant (FBM) Means

Fulfilled by Merchant, or FBM, allows sellers to manage their own inventory storage, packing, and shipping instead of using Amazon’s fulfillment centers. Unlike FBA, Amazon does not handle logistics or customer service, so the seller maintains full control over how products are shipped and delivered. This gives sellers the flexibility to reduce certain fees but also adds operational responsibilities that can affect costs and scalability.

Shipping and Packaging Costs Are on the Seller

With FBM, sellers are responsible for all shipping and packaging costs. While avoiding FBA fees can save money, the reality is that shipping costs can vary widely depending on carrier rates, package size, weight, and destination. Sellers must also invest in packing materials, labels, and potentially software for shipping management. Miscalculations in any of these areas can quickly erode margins that initially appeared stronger than FBA.

Meeting Amazon’s Delivery Expectations

Customers expect fast and reliable shipping, especially on Amazon. FBM sellers are responsible for meeting these expectations, which often means investing in expedited shipping options or negotiating discounted carrier rates. Failing to meet delivery targets can negatively impact seller metrics, which in turn can reduce visibility in search results and limit sales. While FBA automatically provides Prime-level shipping, FBM sellers must manage this themselves, adding both operational effort and potential cost.

Prime Eligibility and Its Impact on Sales

FBM listings are not automatically eligible for Amazon Prime, unless the seller qualifies for Seller Fulfilled Prime. Achieving this status requires maintaining strict shipping performance standards, including fast delivery and consistent reliability. Without Prime eligibility, FBM products may have lower visibility and conversion rates compared to FBA listings, which can indirectly increase the cost per sale due to lost opportunities.

Returns and Customer Service Costs

FBM sellers handle their own returns and customer service. This includes processing refunds, covering return shipping, and responding to buyer inquiries. These responsibilities can be time-consuming and, depending on the volume of orders, may require additional staff or third-party support. While FBM eliminates certain FBA charges, these operational costs are part of the real expense of running an FBM business.

When FBM Makes Financial Sense

FBM can be a smart choice for sellers with unique inventory, oversized items, or low-margin products. It is also useful for those who already have an efficient logistics setup and want to avoid monthly storage and fulfillment fees. However, for sellers with high-volume products or those aiming for Prime visibility, the trade-offs in operational effort, shipping costs, and potential sales impact may outweigh the cost savings.

By understanding how FBM affects fulfillment and shipping costs, sellers can make an informed choice between FBA and FBM based on their product type, sales volume, and long-term business strategy. This cost awareness is critical for evaluating the true expenses of selling on Amazon in 2026.

How Storage and Inventory Holding Fees Affect Your Amazon Costs

Monthly Storage Fees and Why They Add Up Quickly

Beyond fulfillment fees, Amazon charges sellers for storing inventory inside its fulfillment centers. These monthly storage fees are calculated based on the amount of space your products occupy and are billed per cubic foot. While the cost may seem modest on a per-unit basis, it compounds over time, especially for sellers carrying large quantities of inventory or products with slow turnover. Storage costs are incurred regardless of whether a product sells, making them one of the most underestimated ongoing expenses.

Seasonal Storage Rate Increases

Amazon adjusts storage rates during peak shopping periods, typically in the final quarter of the year. During these months, storage fees increase significantly as warehouse demand rises. Sellers who overstock ahead of the holiday season often feel the impact of these higher rates if inventory does not move as quickly as expected. Without careful forecasting, seasonal storage costs can quietly erode profits during what should be the most lucrative time of the year.

Inventory Aging and Why Amazon Penalizes Slow-Moving Stock

In 2026, Amazon continues to emphasize inventory efficiency through inventory aging surcharges. Products that remain unsold beyond certain time thresholds are subject to additional fees, designed to discourage sellers from holding excess stock in fulfillment centers. These surcharges make slow-moving inventory increasingly expensive the longer it sits, turning unsold units into a growing financial liability.

Long-Term Holding Costs and Margin Erosion

When inventory remains in Amazon’s warehouses for extended periods, long-term holding fees can significantly impact margins. These charges are applied on top of regular storage fees and can exceed the original cost of storing the item if inventory is not managed properly. Sellers with seasonal products or inaccurate demand forecasts are especially vulnerable to these accumulating costs.

The Cost of Overstocking vs. Stockouts

Balancing inventory levels is one of the most challenging aspects of selling on Amazon. Overstocking leads to higher storage and aging fees, while stockouts can result in lost sales and reduced listing visibility. Sellers who rely heavily on FBA must constantly weigh the cost of holding inventory against the risk of running out, making inventory planning a critical factor in overall profitability.

Why Storage Fees Are Often Overlooked in Cost Calculations

Many sellers focus primarily on fulfillment and referral fees while underestimating the long-term impact of storage-related costs. Because these fees accrue gradually, they often go unnoticed until margins begin to shrink. When evaluating how much does it really cost to sell on Amazon in 2026, storage and inventory holding fees should be treated as ongoing operational expenses rather than occasional charges.

Understanding storage and inventory holding costs completes another critical layer of Amazon’s fee structure. Once these expenses are accounted for, sellers can begin to evaluate optional but increasingly necessary costs, such as advertising and promotional spend, which now play a major role in visibility and sales performance.

How Amazon Advertising and PPC Costs Impact Your Selling Budget?

Even with a well-optimized listing, organic traffic on Amazon can be limited, especially in competitive categories. Sponsored Ads, Sponsored Products, Sponsored Brands, and Sponsored Display campaigns help sellers reach buyers faster and drive visibility. While advertising can boost sales, it also introduces a variable cost that must be carefully managed. For many sellers, advertising spend can become one of the largest line items after referral and fulfillment fees.

Pay-Per-Click (PPC) Model and Cost Structure

Amazon primarily uses a pay-per-click (PPC) system for advertising. This means sellers pay a fee each time a shopper clicks on their ad, not for impressions. The cost per click (CPC) varies depending on competition, product category, and keyword demand. Popular categories like electronics, beauty, and home goods often have higher CPC rates, while niche or less competitive categories may be more affordable. Understanding CPC trends is critical for budgeting and estimating ROI.

Sponsored Product Ads and Their Costs

Sponsored Product ads are the most widely used format on Amazon. These appear in search results and product pages, directly influencing purchase decisions. Costs are determined by bidding strategies, keyword competition, and relevance. Sellers must balance the bid amount to maintain visibility without overspending, and ongoing monitoring is required to ensure that campaigns remain profitable.

Sponsored Brands and Sponsored Display Ads

Sponsored Brands and Sponsored Display ads offer additional promotional options. Sponsored Brands appear at the top of search results and showcase multiple products, while Sponsored Display can target audiences off Amazon. While these ad types can improve brand awareness and drive incremental sales, they also carry higher CPCs and may require larger budgets to be effective. Sellers must weigh these costs against the expected increase in visibility and conversions.

Budgeting for Advertising in 2026

Advertising costs can fluctuate seasonally, with higher demand and competition during peak shopping periods such as Prime Day, Black Friday, and the holiday season. Sellers need to allocate budgets strategically, monitoring campaigns daily to prevent overspending and ensure positive ROI. Underestimating advertising expenses is a common reason many sellers experience lower-than-expected profits.

Measuring Return on Investment (ROI)

Tracking the impact of advertising on net revenue is critical. A high advertising spend without corresponding sales growth can quickly erode profit margins. Sellers must continuously analyze metrics such as ACOS (Advertising Cost of Sale), ROAS (Return on Ad Spend), and conversion rates to determine whether campaigns are effective. Effective PPC management turns advertising from a cost center into a growth driver.

Strategic Takeaways for Sellers

While Amazon advertising is optional in theory, in practice it is often essential for competing effectively. Sellers must treat advertising as a planned, managed expense rather than an afterthought. When incorporated into overall cost calculations alongside referral fees, fulfillment fees, and storage costs, advertising becomes a key factor in understanding the true cost of selling on Amazon in 2026.

How Returns, Refunds, and Customer Service Impact Your Amazon Costs

The Reality of Product Returns on Amazon

Returns are an inevitable part of selling on Amazon. Whether due to damaged products, customer dissatisfaction, or buyer error, every return carries a cost. Even when the product itself is resold, sellers must consider the time, effort, and shipping expenses involved in processing returns. For sellers relying on FBA, Amazon handles returns, but the costs are passed on through deductions from your account, which can impact net profit.

Refund Processing and Associated Fees

When a buyer requests a refund, Amazon automatically returns the purchase amount, minus any applicable fees. For FBA sellers, referral fees are not reimbursed even if the item is returned. Additionally, if the returned product cannot be resold as new, because it is damaged or opened, its value is effectively lost. For FBM sellers, refund costs include both the refunded price and any return shipping or restocking expenses, which must be managed internally.

Customer Service Responsibilities

Customer satisfaction is a key metric for maintaining seller health and ranking on Amazon. FBM sellers handle all customer service directly, including inquiries, complaints, and return approvals. This often requires dedicated time, staff, or outsourcing, which adds to operational costs. FBA sellers have these tasks managed by Amazon, but the costs are indirectly included in fulfillment and referral fees.

How Returns Affect Inventory and Fulfillment Costs

Returned items can also increase storage and fulfillment costs. For FBA, returned units take up space in fulfillment centers until they are resold or disposed of, contributing to additional storage fees. FBM sellers must handle restocking or warehousing, which adds complexity and potential labor costs. This is especially significant for seasonal items or products with limited shelf life, where returns can create compounded financial impact.

Planning for Returns in Profit Calculations

Smart sellers build potential return rates into their pricing and cost projections. A high return rate can significantly reduce profit margins, even for products that appear successful at first glance. Understanding the likelihood of returns by category and product type helps sellers budget appropriately and avoid surprises at the end of the month.

Why Returns and Customer Service Are Part of True Selling Costs

While often overlooked, returns, refunds, and customer service are as much a part of selling costs as referral fees, FBA, or advertising. Factoring these into your calculations ensures a more accurate understanding of net profitability and helps sellers plan for sustainable business growth on Amazon in 2026.

Hidden and Often Overlooked Amazon Selling Expenses

Why Hidden Costs Matter

Even after accounting for seller plans, referral fees, fulfillment costs, storage, advertising, and returns, many Amazon sellers are surprised by additional expenses that quietly eat into profit. These hidden costs can make a profitable-looking product far less lucrative than expected. Understanding them is critical for accurately answering the question – how much does it really cost to sell on Amazon in 2026?

Packaging and Labeling Costs

Every product listed on Amazon requires proper packaging and labeling to meet marketplace standards. For FBA, Amazon expects products to be packaged securely, often with branded packaging, bubble wrap, or polybags. FBM sellers must handle this themselves. These costs, while small per unit, can add up quickly across large inventory volumes. Mistakes in packaging or labeling can also result in penalties or rejected shipments, further increasing expenses.

Software and Tools for Selling

Many sellers rely on software for inventory management, repricing, keyword research, and PPC optimization. While these tools improve efficiency and sales performance, they also come with recurring subscription fees. Ignoring these operational costs can give a false sense of profitability, as monthly software expenses can rival or exceed other smaller fees in certain scenarios.

High-Volume and Seasonal Surcharges

Amazon applies additional fees during peak seasons or for high-volume sellers. These can include increased storage fees, fulfillment surcharges, or peak-season shipping costs. Sellers who stock heavily for holidays like Prime Day or Black Friday often underestimate these charges, only to find that the surge in revenue is partially offset by increased operating expenses.

Promotional and Discount Costs

Running deals, coupons, or discounts is common on Amazon to drive visibility and conversion rates. While these strategies can boost sales, they reduce the net amount received per unit sold. Sellers must plan for these promotional expenses and include them in profitability calculations to avoid overestimating margins.

Account Health and Performance Penalties

Amazon monitors seller performance closely. Late shipments, high order defect rates, or negative reviews can result in temporary restrictions, account suspensions, or additional fees for remediation. While not recurring in the traditional sense, these costs can be substantial if sellers fail to maintain high operational standards.

Miscellaneous Operational Expenses

Other overlooked costs include returns handling beyond standard refunds, restocking fees, international shipping for cross-border sales, and additional packaging for fragile items. Each of these minor expenses may seem negligible individually, but together they create a meaningful impact on overall profitability.

Planning for Hidden Costs

Successful Amazon sellers build a buffer for these hidden and operational costs into their pricing and profit models. By understanding every layer of expense, from referral fees to hidden charges, sellers can make informed decisions about product selection, pricing strategy, and inventory management, ensuring that they maintain sustainable profitability.

How Can a Hybrid Fulfillment Strategy and Cost Monitoring Improve Your Amazon Profits?

Selling on Amazon in 2026 isn’t just about listing products and hoping for sales. The difference between a profitable store and one that barely breaks even often comes down to how you manage fulfillment and track every cost. A hybrid fulfillment strategy combined with careful cost monitoring can help sellers reduce unnecessary expenses, improve margins, and make smarter operational decisions.

1. Understanding Hybrid Fulfillment

A hybrid fulfillment strategy means using both FBA and FBM strategically, rather than relying solely on one. Instead of paying FBA fees for every product or handling all logistics yourself, you can assign products to the method that maximizes profitability.

- FBA for high-volume, fast-selling items: These products benefit from Prime eligibility, faster delivery, and better visibility. While fees are higher, the increased sales velocity often justifies the cost.

- FBM for low-volume, oversized, or low-margin products: Avoid unnecessary FBA storage and fulfillment fees. Using FBM for these items allows you to save on costs without losing control over shipping and handling.

This approach ensures your money is spent where it matters most, on products that generate real revenue.

2. How to Decide Which Products Go FBA or FBM

Not all products are created equal, and their fulfillment needs vary. Consider:

- Product size and weight: Heavy or bulky items can cost significantly more in FBA. FBM may be the better choice for these.

- Sales velocity: Fast-moving products benefit from FBA’s automatic Prime access. Slow movers risk long-term storage fees in FBA.

- Margins: Low-margin products may not withstand FBA fees but can still be profitable under FBM.

- Seasonality: Seasonal or limited-demand items may be more cost-effective under FBM to avoid peak storage surcharges.

By categorizing products this way, sellers can allocate inventory intelligently, saving money while maintaining sales performance.

3. Monitoring Costs at Every Step

A hybrid strategy works only when paired with active cost monitoring. Tracking every expense, referral fees, FBA charges, FBM shipping, advertising, returns, and hidden fees, ensures you understand true profitability per product.

Key steps:

- Track per-unit cost: Include all fees, packaging, and shipping expenses in your calculations.

- Analyze profitability by category: Compare which products perform best under FBA vs FBM.

- Monitor PPC campaigns: Evaluate advertising ROI per product to avoid overspending.

- Evaluate returns: Factor in the cost of returns and refunds, which can vary by product type.

This creates a realistic, data-driven view of your profit margins rather than relying on gross sales alone.

4. Benefits of Combining Hybrid Fulfillment and Cost Monitoring

Sellers who implement this strategy enjoy several advantages:

- Lower overall costs: Avoid paying FBA fees for products better suited for FBM.

- Improved cash flow: Reducing storage and fulfillment fees frees up working capital.

- Smarter inventory allocation: Ensure high-demand products get maximum visibility while low-demand products remain cost-efficient.

- Data-driven decisions: Optimize pricing, advertising, and fulfillment based on real numbers rather than estimates.

In essence, hybrid fulfillment combined with cost monitoring turns cost awareness into a strategic advantage, rather than letting fees silently erode profits.

5. Actionable Steps to Implement This Strategy

- Audit your inventory: Identify which products are fast-moving, high-margin, low-margin, or oversized.

- Split fulfillment smartly: Send high-volume products to FBA and low-volume or bulky items to FBM.

- Track costs diligently: Use spreadsheets or Amazon tools to capture every fee, shipping cost, and refund.

- Review quarterly: Reassess fulfillment assignments, advertising efficiency, and inventory levels regularly to stay profitable.

By combining hybrid fulfillment with cost monitoring, sellers gain a complete view of their expenses, make smarter operational decisions, and maintain strong margins even in competitive markets.

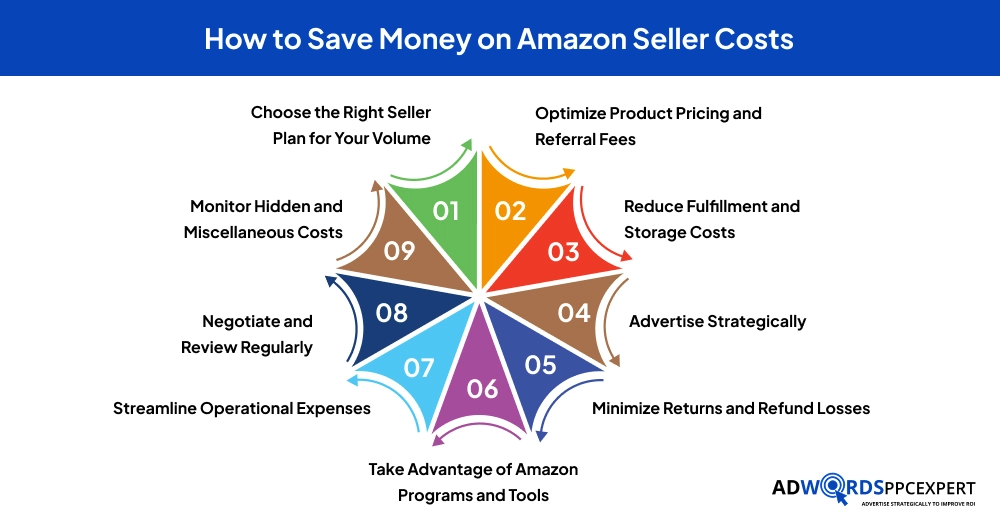

How to Save Money on Amazon Seller Costs in 2026

Selling on Amazon can be profitable, but only if costs are carefully managed. After understanding all the layers, from referral fees and FBA to advertising and hidden expenses, sellers can take actionable steps to reduce costs and protect their profit margins. Here is how.

Choose the Right Seller Plan for Your Volume

Selecting the right plan is the first step toward cost efficiency. If your sales are low or you are testing products, the Individual seller plan avoids the $39.99 monthly Professional fee. However, for higher-volume sellers, the Professional plan provides access to bulk tools and advertising options that can improve efficiency and sales velocity. Matching your plan to your sales volume prevents unnecessary monthly expenses.

Optimize Product Pricing and Referral Fees

Referral fees are unavoidable, but careful pricing can help absorb them. Evaluate your category’s fee percentage and set product prices that maintain a healthy margin after Amazon takes its commission. Bundling products or offering higher-value items can sometimes offset high referral fees, improving profitability without reducing competitiveness.

Reduce Fulfillment and Storage Costs

For FBA sellers, fulfillment and storage are major expenses. Reducing storage fees starts with smarter inventory management: avoid overstocking, send products in smaller batches, and monitor inventory aging reports. Using FBM strategically for low-volume or oversized products can also cut fulfillment fees, giving sellers greater control over shipping costs.

Advertise Strategically

PPC advertising is essential for visibility, but unplanned spending can quickly drain profits. Focus on high-converting keywords, adjust bids based on performance, and pause underperforming campaigns. Seasonal spikes in ad spend should be carefully budgeted so that promotions and sponsored ads actually boost ROI instead of eroding margins.

Minimize Returns and Refund Losses

Returns can significantly impact net revenue. Clear product descriptions, high-quality images, and accurate sizing or specifications reduce the likelihood of returns. For FBM sellers, timely responses to customer inquiries and proactive support help prevent complaints from escalating into costly returns.

Take Advantage of Amazon Programs and Tools

Amazon offers tools and programs that can save money over time. Using FBA’s small and light program for low-weight items, automating inventory alerts, and leveraging bulk shipping discounts are just a few ways sellers can reduce operational costs. Software tools for repricing, inventory management, and PPC tracking can also optimize spending and prevent hidden losses.

Streamline Operational Expenses

Even minor operational costs can add up. Packaging, labeling, and shipping supplies should be sourced cost-effectively, and processes should be streamlined to reduce labor hours. Regularly review subscription tools, fulfillment methods, and logistics strategies to eliminate unnecessary expenses without compromising customer experience.

Negotiate and Review Regularly

Amazon fees and operational costs are not static. Sellers who regularly review fee structures, compare shipping options, and negotiate with service providers often find new opportunities to save. Continual evaluation ensures that your business adapts to changing costs while maintaining profitability.

Monitor Hidden and Miscellaneous Costs

Even experienced sellers can underestimate certain expenses that quietly eat into profits. Costs such as packaging, labeling, and shipping materials may seem minor per unit, but they add up quickly across large inventories. Seasonal surcharges, peak-time fulfillment fees, or additional handling charges can also inflate expenses unexpectedly. On top of that, returns processing, outsourced customer support, or other operational tasks often carry hidden costs that do not appear in the standard fee breakdown. To maintain accurate profitability, it is essential to include all of these expenses in your pricing and financial models.

Wrapping Up!

Selling on Amazon in 2026 offers great opportunities, but success depends on understanding the full range of costs involved. From seller plans and referral fees to FBA/FBM fulfillment, advertising, returns, and hidden expenses, each layer affects your profit margins. By combining a hybrid fulfillment strategy with careful cost monitoring, sellers can make smarter decisions about inventory, pricing, and advertising. Efficient inventory management, minimizing returns, and tracking operational expenses further protect your margins. When these strategies are applied consistently, they turn cost awareness into a competitive advantage. Ultimately, knowing how much it really costs to sell on Amazon empowers you to maximize profitability and grow a sustainable, successful business.

Frequently Asked Questions (FAQs)

1. How much does it really cost to sell on Amazon in 2026?

The cost depends on several factors, including your seller plan, referral fees, fulfillment method (FBA or FBM), storage fees, advertising, and hidden operational costs. On average, total expenses can range from 15% to 40% of the sale price, depending on product type and volume.

2. Should I use FBA or FBM to save money?

It depends on your product and sales strategy. FBA is ideal for fast-moving, high-volume items with Prime eligibility, while FBM can be more cost-effective for low-volume, oversized, or low-margin products. Many sellers use a hybrid approach to optimize costs.

3. What are hidden Amazon seller costs I should watch for?

Hidden costs include packaging and labeling, seasonal surcharges, returns processing, outsourced customer support, and software or tools for inventory and PPC management. These can quietly reduce profitability if not monitored.

4. Can advertising costs really affect my profitability?

Yes. Poorly optimized PPC campaigns can quickly eat into profits. Monitoring your Advertising Cost of Sale (ACOS) and focusing on high-performing keywords ensures that ad spend drives revenue without eroding margins.

5. Is it worth using a hybrid fulfillment strategy?

Absolutely. Combining FBA and FBM strategically allows sellers to control costs, optimize inventory placement, and maintain Prime benefits for high-demand products while avoiding unnecessary fees on slower-moving items.

Ami Singh is a highly skilled AdWords PPC Specialist, known for creating profitable Google Ads strategies that elevate brands. With deep expertise in Google Search, Display, Shopping, YouTube Ads, and advanced bidding techniques, Ami consistently converts data into performance-driven results.

With a sharp analytical mind and a strong understanding of online consumer behavior, Ami designs campaigns that maximize ROI, boost quality scores, and reduce acquisition costs. His approach blends technical expertise with strategic thinking—making him a go-to expert for businesses aiming to dominate Google Ads.

Ami doesn’t just adapt to the fast-changing PPC industry, but he also stays ahead of the curve by testing new features, adopting automation smartly, and refining what works. Clients trust him for his transparency, insights, and ability to scale campaigns sustainably.

Looking to take your Google AdWords performance to the next level? Connect with Ami Singh at Softtrix and discover how he can help you get the maximum growth through powerful PPC strategies.